Wednesday, 11 October 2023

UnitedHealth earnings preview: Another beat in cards despite cost concerns

by Rose White

Over the years, UnitedHealth Group Incorporated (NYSE: UNH) has expanded steadily through diversification and acquisitions, all along creating value for shareholders. The healthcare conglomerate has the potential to stay on the growth path for the long term, considering the rising demand for healthcare services and the aging population. Going by recent initiatives like the acquisition of tech firm Change Healthcare, the company looks set for an AI-supported expansion going forward.

A Good Bet?

UnitedHealth’s stock has gone through a series of ups and downs in the recent past and is trading near where it was a year earlier. The company has a good track record of emerging unscathed from market headwinds, on the strength of its successful business model and strong fundamentals. UNH is a dividend payer being followed closely by income investors — it currently offers a yield of 1.6% which is broadly in line with the S&P 500 average. The stock is an investors’ favorite, and it becomes more attractive when the anticipated tailwinds are factored in. Moreover, it is trading at a discount, and the company’s balance sheet is pretty strong.

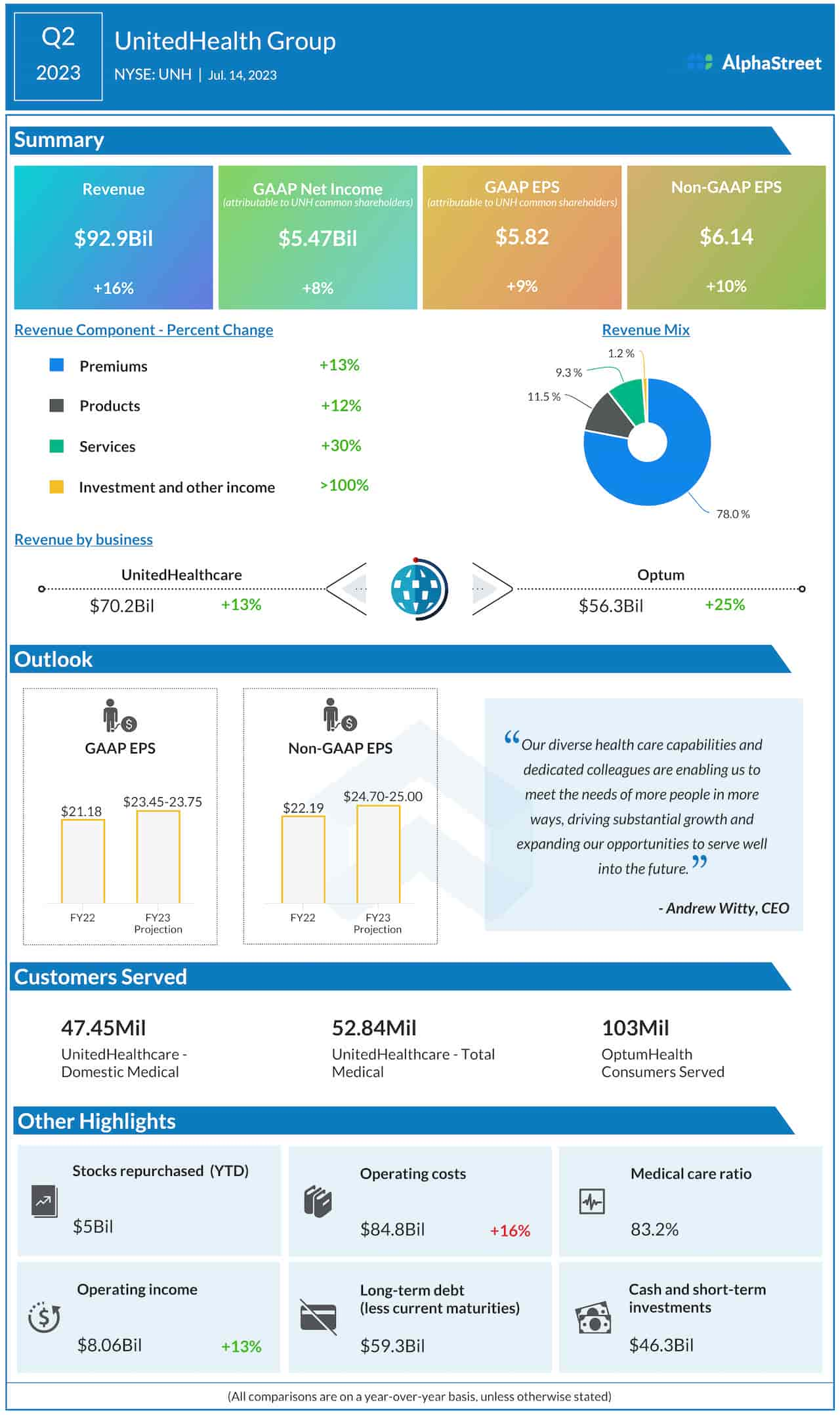

The core UnitedHealthcare segment and Optum – the pharmacy care services division — serve a total of 53 million and 103 million customers respectively. And, the numbers are growing every quarter, validating the relevance of the company’s diversified portfolio. Recently, UnitedHealth executives raised the full-year earnings guidance as they expect an increase in activity in the coming months – more people seek care amid pent-up demand for elective surgical procedures.

Higher Costs

Meanwhile, there is an increase in care costs even as the healthcare sector returns to the pre-pandemic levels. The higher costs would put the company’s medical insurance business under pressure due to bigger claim amounts.

From UnitedHealth’s Q2 2023 earnings call:

“Even in this challenging funding environment, we continue to prioritize the stability and affordability our members have come to rely on from UnitedHealthcare. We’re confident that next year, we will once again grow at a pace exceeding that of the broader market. While at a much lesser impact than senior outpatient care, we also are seeing increased care activity in behavioral. Over the past few years, behavioral care patterns have been accelerating as people increasingly feel comfortable seeking services.”

Earnings

Over the past several years, UnitedHealth has reported impressive quarterly earnings that either surpassed or met estimates consistently. When the company reports third-quarter results on October 13, 2023, at 5:55 a.m. ET, the outcome will likely be in line with the long-term trend. Market watchers estimate an adjusted profit of $6.32 per share, which is up 9% year-over-year. The consensus revenue forecast is $91.32 billion, which represents a 13% year-over-year increase.

The company delivered better-than-expected quarterly revenues in recent years, including in the June quarter when the top line jumped 16% annually to $92.9 billion. All business divisions – Premiums, Products, Services, and Investment & Other Income – grew in double-digits. As a result, there was a 10% increase in adjusted earnings to $6.14 per share.

Shares of UnitedHealth closed the last session at $516.23, after trading higher during the day. It has gained 9% in the past 30 days.

The post UnitedHealth earnings preview: Another beat in cards despite cost concerns first appeared on AlphaStreet.