Thursday, 7 September 2023

A look at Hormel Foods’ (HRL) expectations for the remainder of the year

by Rose White

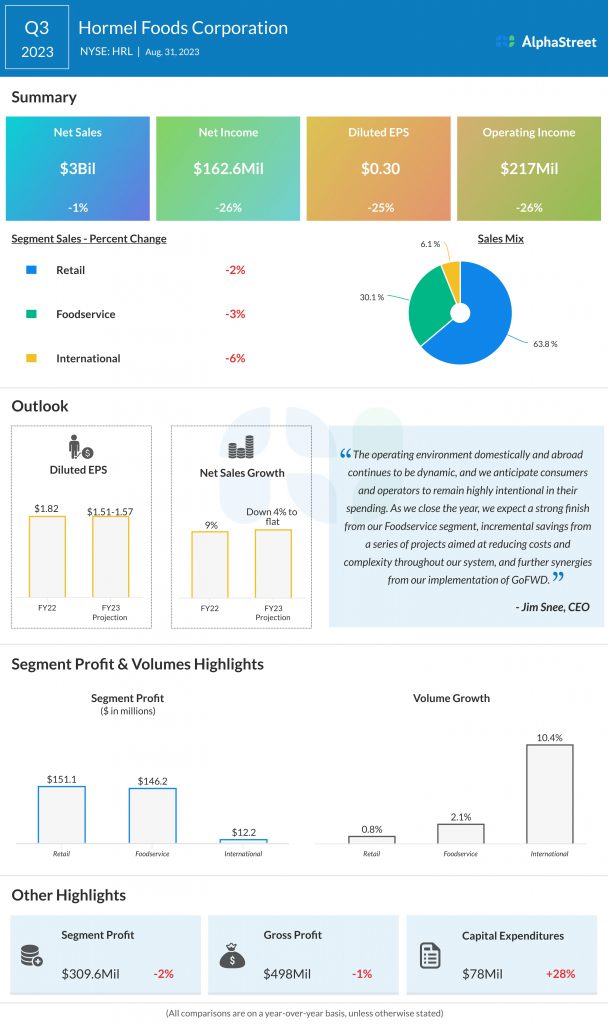

Shares of Hormel Foods Corporation (NYSE: HRL) were down over 1% on Tuesday. The stock has dropped 16% year-to-date. The company delivered disappointing results for its most recent quarter last week and lowered its outlook as well. Here’s a look at its expectations for the remainder of the year:

Sales and volumes

In the third quarter of 2023, Hormel generated net sales of $3 billion, which was down 1% from the same period a year ago. The company saw broadbased volume growth for the quarter, driven by a recovery in turkey, strong demand for many foodservice items and growth in retail brands.

Hormel expects modest volume growth for the fourth quarter of 2023, assuming growth in Foodservice, recovery in turkey and improved fill rates in key categories. Net sales for Q4 2023 are expected to range between $3.1-3.6 billion. For the full year of 2023, net sales are expected to be down 4% to flat.

Profits

Hormel delivered GAAP EPS of $0.30 in Q3 2023, which was down 25% from the prior-year quarter. Adjusted EPS was $0.40 which was comparable to last year. For the fourth quarter, EPS is expected to be down from last year, reflecting softness in the Retail and International segments. For the full year of 2023, GAAP EPS is expected to be $1.51-1.57 while adjusted EPS is expected to be $1.61-1.67.

Category performance

Hormel saw net sales decline across all its segments in Q3. Volumes, on the other hand, were up across all divisions. In the Retail segment, the company saw volume growth across key categories while the turkey portfolio witnessed a recovery.

Hormel saw volume gains in the snacking category led by Planters snack nuts, Hormel Gatherings Party Trays, and CORN NUTS corn kernels. Holiday demand is expected to drive further gains for the Planters and Hormel Gatherings brands towards the end of the year. Sales in Retail were down 2% due to tough prior-year comparisons for Skippy spreads and lower market-driven pricing on raw bacon items.

The Foodservice segment saw volume growth of 2% helped by strong demand in branded categories and premium prepared proteins. Sales in the segment fell 3% due to lower market-driven pricing. Hormel expects gains from this segment, driven by growth in premium items and further recovery in turkey.

The post A look at Hormel Foods’ (HRL) expectations for the remainder of the year first appeared on AlphaStreet.